- Yield Quest

- Posts

- Tokenizing Trillions: How Re.al is Unlocking Real-World Asset Yields

Tokenizing Trillions: How Re.al is Unlocking Real-World Asset Yields

Issue #10

Welcome to The Yield Quest Guide!

Dear Yield Pioneers,

While most chains chase speculative DeFi yields, Re.al Protocol is building the infrastructure to tokenize the $16 trillion real-world asset (RWA) market. From T-Bills to Tokyo high-rises, this isn’t just another DeFi protocol—it’s where blockchain meets institutional-grade returns. Let’s explore how Re.al is bridging traditional finance and Web3, and why BlackRock’s BUIDL fund is betting big on its success.

If you haven't already… Hit the subscribe button so you can Invest Wisely and Yield Richly

In This Issue

Protocol Deep Dive: Re.al’s three-layer architecture for RWAs

Yield Blueprint: 9.8% APY strategy using tokenized T-Bills

Institutional Moves: BlackRock’s $280M play and Spiko’s money market migration

Network Analytics: $40M TVL and 18% monthly bridge growth

Weekly Protocol Spotlight: Re.al’s RWA Engine

The Tokenization Gap

Traditional finance locks $16T in assets behind paper contracts and 90-day settlement cycles.

Re.al Protocol disrupts this through:

Fractional ownership of commercial real estate via ERC-20 tokens

Yield stripping that separates asset appreciation from income rights

Basket tokens pooling properties into liquid digital shares

Architecture Breakthrough

Built on Arbitrum Orbit, Re.al combines TradFi compliance with DeFi efficiency:

1. Tokenization Layer:

Converts physical assets (real estate, T-Bills) into blockchain tokens

190+ properties live, including Miami condos and Tokyo office towers

2. Yield Engine:

Automatically distributes rental income and T-Bill yields

8-12% APY on stablecoin-aligned returns

3. Compliance Mesh:

KYC-enabled subnets for institutions like JPMorgan

GDPR-compliant data lanes for EU investors

Quick-Start Guide: 9.8% APY T-Bill Strategy

Requirements:

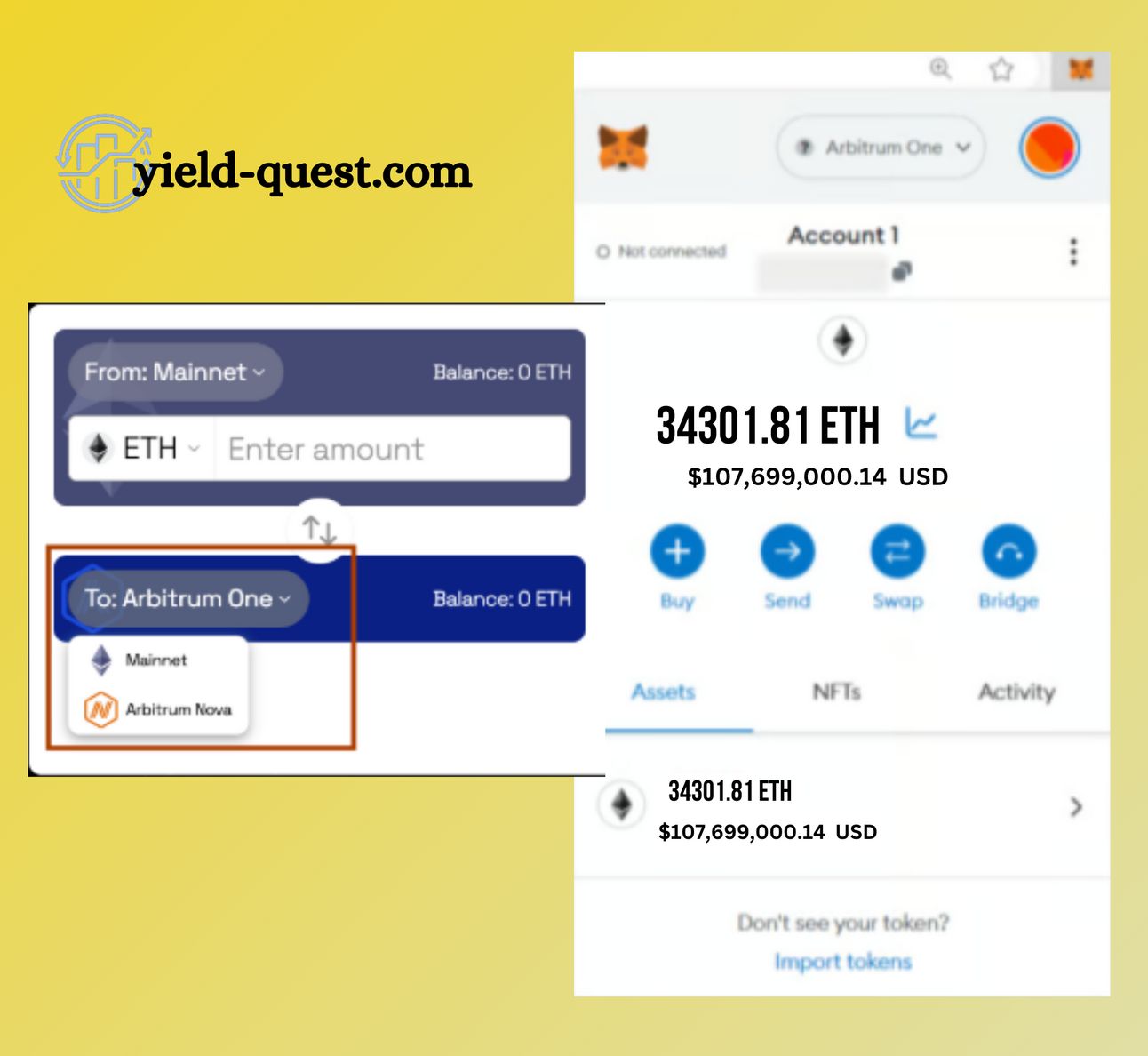

USDC: Minimum $100 (bridge from Ethereum/other chains)

Web3 Wallet: MetaMask or Core (Arbitrum-compatible)

ETH for Gas: Keep 0.01-0.05 ETH on Arbitrum (~$0.50-$2.50 per tx)

Step 1: Mint re.USDC (T-Bill-Backed Stablecoin)

Connect Wallet: Navigate to Re.al Portal and link your wallet.

Select “Mint re.USDC”: Enter the amount (minimum $100) and approve the transaction.

Verify Balance: Check your wallet for re.USDC tokens (1:1 backed by U.S. T-Bills).

Pro Tip: Mint during off-peak hours (UTC 00:00–04:00) for lower gas fees.

Step 2: Stake in Treasury Vault

Access Vaults: From the Re.al dashboard, select “Treasury Vaults.”

Deposit re.USDC: Enter your balance or a custom amount.

Enable Auto-Compounding: Toggle “Auto-Reinvest” to boost APY by ~1.2%.

Yield Breakdown

- Base Yield: 6.5% APY (from actual T-Bill returns)

- Protocol Incentives: +3.3% APY (paid in REA tokens)

- Total APY: 9.8%+ (with daily compounding)

Step 3: Optimize Cross-Chain Exposure

Bridge to Ethereum: Use LayerZero to transfer re.USDC.

Deploy as Collateral: Deposit re.USDC into Aave v3 and borrow stablecoins (5-7% APY).

Recycle Liquidity: Bridge borrowed stablecoins back to Arbitrum to mint more re.USDC.

Advanced Play: Use recursive borrowing to amplify yields (monitor health factors closely).

Step 4: Monitor & Compound

Track Earnings: Use Re.al’s dashboard to view T-Bill yields and REA rewards.

Manual Compounding: Reinvest weekly if auto-compounding lags.

Withdraw Options:

Standard: 2-3 days (matches T-Bill settlement)

Instant: 0.5% fee for immediate access

Strategy Spotlight

1. Property Basket Rotation

Auto-rebalances top 5 commercial real estate pools monthly

Combines rental yields (4-7%) with appreciation potential

2. BlackRock’s BUIDL Integration

Access tokenized shares of a $280M institutional portfolio

Combines TradFi due diligence with blockchain liquidity

3. Cross-Chain Collateral

Use property NFTs as collateral on Avalanche/Arbitrum lending markets

Stack yields through recursive borrowing strategies

Innovations Redefining RWAs

1. Dynamic Yield Splitting

Sell a condo’s rental rights while retaining equity exposure

Algorithms auto-optimize across 190+ asset pools

2. Liquidity Mining 2.0

Earn REA tokens for providing basket token liquidity

100% protocol fees redistributed to stakers

3. Enterprise Subnets

JPMorgan testing private REIT subnet for compliant trading

GDPR-compliant data lanes for European investors

RWA Market Pulse

- $40M TVL locked in first 90 days

- 18% monthly growth in bridge volume

- 2-hour settlement vs 90 days in traditional markets

- $50 minimums vs $25K+ for private REITs

Why This Matters Now

Regulatory Tailwinds: SEC’s security token guidance favors compliant protocols.

Institutional Demand: BlackRock’s BUIDL proves TradFi needs blockchain RWAs.

Yield Arbitrage: 5.6% gap between traditional T-Bills and Re.al’s tokenized yields.

Final Thought

Re.al isn’t just another DeFi protocol—it’s the first credible bridge between crypto yields and Warren Buffett-grade assets. As pension funds and family offices allocate, the real question is: Will you front-run them?

Disclaimer: This newsletter contains alpha, not advice. RWAs carry unique regulatory/illiquidity risks. Always DYOR.

Stay Ahead of the Curve,

The Yield Quest Team