- Yield Quest

- Posts

- Bitcoin Layer 2: Transforming Digital Gold into Scalable Finance

Bitcoin Layer 2: Transforming Digital Gold into Scalable Finance

The Yield Quest: Issue #1

Welcome to The Yield Quest Guide!

Dear Yield Finders,

Bitcoin is evolving—fast. No longer just “digital gold,” it’s becoming the backbone of decentralized finance (DeFi), payments, and smart contracts. At the heart of this transformation are Layer 2 (L2) solutions like the Lightning Network, Rootstock (RSK), and zk-proofs. These tools promise faster transactions, lower fees, and broader functionality for users and developers—but navigating the risks and rewards is critical.

If you haven’t already… Hit the subscribe button so you can Invest Wisely and Yield Richly

In This Issue:

Weekly Chain Highlight: How Bitcoin Layer 2 is reshaping scalability and DeFi.

Quick-Start Guide: BTC Liquidity Pool Strategy: Step-by-step instructions to earn yields and bonus rewards on your Bitcoin holdings.

Strategy Spotlight: Generate income and access liquidity with Lightning, Liquid, and RSK.

Techovations Inn: zk-proofs, decentralized bridges, and non-custodial Bitcoin assets explained.

Challenges Unpacked: Centralization, liquidity, and governance pitfalls dissected.

A solution to complex hurdles: The critical obstacles holding back Bitcoin Layer 2 adoption—and how they can be fixed.

Weekly Chain Highlight

Bitcoin Layer 2 solutions are transforming how the blockchain operates. By processing transactions off-chain, they reduce congestion, cut costs, and introduce programmable capabilities like DeFi and smart contracts.

Lightning Network: Optimized for fast, micro-transactions. A global remittance tool that outpaces traditional systems.

Liquid Network: Built for institutions. Offers confidential transactions and tools for tokenizing assets.

Rootstock (RSK): Brings Ethereum’s dApp ecosystem to Bitcoin, enhancing Bitcoin's DeFi potential.

These solutions don’t replace Bitcoin’s core strengths—they amplify them. By embracing Layer 2, Bitcoin evolves from a store of value into a dynamic foundation for a decentralized financial system, securing its relevance in an ever-competitive blockchain landscape.

Quick-Start Guide: BTC Liquidity Pool Strategy

If you’re looking to maximize your Bitcoin holdings with minimal effort, this guide explains how to earn APY on your BTC through Pendle liquidity pools (LPs) while taking advantage of bonus rewards from Infinit Labs’ airdrop campaign. With potential yields ranging from 21% to 149% APY, this strategy is simple and effective.

What You’ll Need

A Crypto Wallet: Ensure it supports Pendle and Infinit (e.g., MetaMask).

BTC or Wrapped BTC: You’ll need BTC or equivalent assets like eBTC to provide liquidity.

Access to Pendle Protocol: Visit Pendle to interact with eligible pools.

Gas Fees: A small amount of ETH or the network’s native token for transaction fees.

Step-by-Step Instructions

Step 1: Provide Liquidity to Eligible Pools

Go to Pendle Finance.

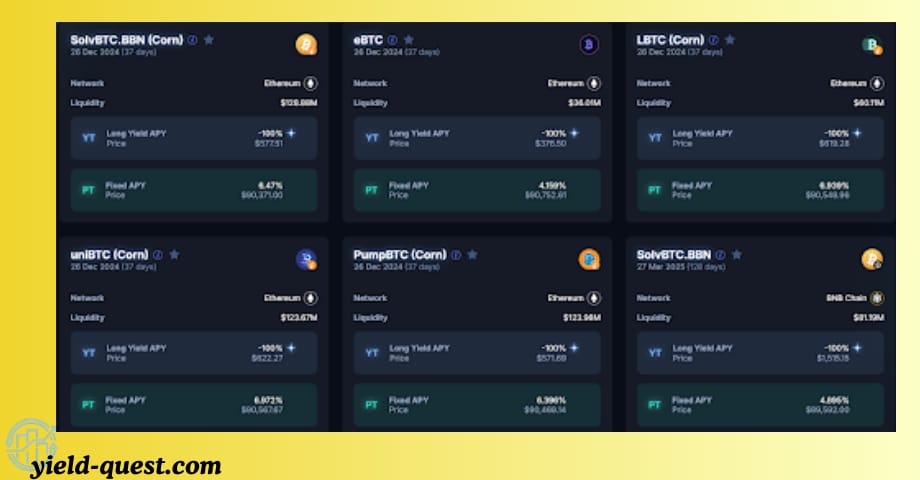

Select one of the eligible BTC liquidity pools:

Corn LBTC 26DEC2024

Corn SolvBTC.BBN 26DEC2024

eBTC 26DEC2024

Deposit BTC or equivalent tokens into the pool. This action makes you a liquidity provider (LP).

Start earning base APYs on your deposits.

Step 2: Claim Infinit Stones for Bonus Rewards

Visit Infinit Labs Rewards.

Connect your wallet used for providing liquidity.

Automatically qualify to earn Stones, Infinit Labs’ reward points convertible into airdrops.

Infinit Stones are capped at 6.244 billion per epoch (roughly three months), ensuring limited dilution and additional yield for participants.

Step 3: Optimize and Monitor Your Yields

Track your Stones and rewards on the Infinit rewards page.

Higher Infinit valuations translate to better APYs.

Consider reinvesting additional rewards into eligible pools for compounding returns.

Yield Sources:

Where Your Earnings Come From

Your income in this strategy comes from two primary sources:

Base APYs from Pendle Pools

Yield from trading fees generated by the liquidity pools.

Earned passively as an LP in eligible pools.

Bonus Rewards from Infinit Stones

Stones earned from Infinit Labs’ campaign, convertible to airdrops.

The actual value depends on Infinit’s future market valuation.

Potential Yields

Base APY: Consistent returns directly from Pendle pools, typically in the range of ~6%-15%.

Infinit Bonus APY: An extra 21%-149% APY, depending on Infinit's valuation and campaign participation.

Total Yield Potential: Up to 164% APY when combining base pool yields with Infinit rewards.

Risks to Consider

Market Volatility: BTC price fluctuations can affect the value of your liquidity position.

Impermanent Loss: Changes in the price of assets in the pool relative to BTC could impact your returns.

Protocol Risk:

Smart contract vulnerabilities in Pendle or Infinit Labs.

Ensure pools are audited and platforms are reputable.

Valuation Uncertainty:

The value of Infinit Stones depends on Infinit’s future valuation.

If Infinit fails to meet projected valuations, bonus yields may be lower than expected.

Pros and Cons

Pros:

High Yield Potential: Up to 164% APY when factoring in Infinit bonuses.

Low Maintenance: No active management required beyond connecting your wallet.

Limited Dilution: Stones are capped per epoch, ensuring fair distribution.

BTC Exposure: Continue holding BTC while earning returns.

Cons:

Market Dependency: Returns tied to BTC price and Infinit valuation.

Technical Barriers: Requires familiarity with DeFi tools and gas fees.

Impermanent Loss Risk: Potential losses if asset prices diverge significantly.

Strategy Spotlight

Operate Lightning Channels

Earn Routing Fees: Set up payment channels and earn fees for routing transactions. Tools like Amboss and ThunderHub make it easy to get started.

Pro Tip: Focus on high-traffic nodes for maximum earnings.

Leverage Liquidity for Asset Issuance

Tokenize real-world assets or create confidential Bitcoin-backed stablecoins.

Mint DLLR Stablecoins with Sovryn

Use Sovryn’s Zero Loan system to mint DLLR, a Bitcoin-backed stablecoin, and access interest-free liquidity.

Participate in RSK Yield Farming

Use Sovryn to earn sustainable yields via Bitcoin-backed liquidity pools.

Recent Innovations in Bitcoin Layer 2

1. zk-Proofs (ZKPs)

The Big Deal: zk-proofs validate transactions without revealing sensitive details, enhancing privacy and scalability.

Breakthrough: BitcoinOS recently verified the first zk-proof on Bitcoin’s mainnet, paving the way for scalable, private transactions.

2. Decentralized Bridges

RenBridge: Transfers Bitcoin to Ethereum as renBTC without custodians.

Avalanche Bridge: Offers secure, low-cost Bitcoin integration with Avalanche’s DeFi ecosystem.

sBTC and FBTC: Decentralized alternatives to WBTC, removing the need for centralized custodians and reducing risks.

What’s Holding Back the Revolution?

Bitcoin Layer 2 solutions promise to transform Bitcoin, but they face critical hurdles. These challenges aren’t just technical—they could directly impact adoption and returns. Here’s what’s holding Bitcoin Layer 2 back:

1. Centralization Risks

Custodial Dependence: Solutions like WBTC rely on centralized custodians, creating single points of failure.

Validator Concentration: Limited operators or validators reduce system decentralization and resilience.

Why It’s a Problem: Centralization undermines Bitcoin’s trustless, censorship-resistant ethos.

2. Liquidity Challenges

Low Liquidity: Many L2 platforms lack sufficient liquidity, leading to inefficiencies like high slippage.

Fragmentation: Liquidity is scattered across different protocols, reducing its effectiveness.

Impact: Higher costs, reduced yields, and slower adoption.

3. Accessibility Barriers

Complex Interfaces: Non-intuitive platforms intimidate new users.

Technical Knowledge Requirements: Setting up wallets, handling gas fees, and navigating L2 tools can be overwhelming.

Result: Fewer users willing to engage with these technologies.

4. Scalability Bottlenecks

Congestion on L2: Popular Layer 2 solutions can face traffic spikes, reducing their speed and efficiency.

Rollup Constraints: Reliance on Bitcoin for data availability can lead to delays and higher costs.

Consequence: Slower, costlier transactions deter users.

5. Governance Weaknesses

Opaque Decision-Making: Lack of transparency in governance leads to poor user trust.

Manipulation Risks: Concentrated power creates opportunities for exploitation, as seen in the SAVM incident.

Impact: Poor governance could sink user confidence—and investments.

Solutions for Bitcoin Layer 2 Challenges

Bitcoin Layer 2 solutions must adapt quickly to ensure scalability and decentralization. Here are the most effective strategies to address these challenges:

1. Enhance Decentralization

Non-Custodial Models: Support platforms like sBTC and FBTC to eliminate custodial risks.

Distributed Validator Sets: Expand the number of operators or validators for greater decentralization.

2. Boost Liquidity

Incentivize Providers: Offer competitive APYs and rewards to attract liquidity.

Unify Liquidity: Develop bridges and aggregators to consolidate liquidity across L2 platforms.

3. Improve Accessibility

Simplify Interfaces: Design user-friendly tools that resemble mainstream apps.

Educational Support: Offer tutorials, guides, and FAQs to lower entry barriers.

4. Innovate Scalability

Advanced Rollups: Use zk-rollups and BitSNARK to compress data and increase throughput.

Layer 2 Interoperability: Enable seamless communication between L2 platforms to reduce fragmentation.

5. Strengthen Governance

Decentralized Voting Systems: Use DAOs to ensure transparent, fair decision-making.

Auditable Protocols: Publish open-source code and regular audits to build trust.

Bitcoin’s future hinges on Layer 2. From scalable rollups to programmable smart contracts, these tools are transforming the blockchain. Now is your time to act. Explore Lightning for payments, Liquid for asset issuance, Aqua Wallet for open-source Bitcoin and Stablecoin Wallet as or Sovryn for decentralized finance. Stay ahead—because the next wave of Bitcoin innovation is happening right now.

Disclaimer

All information provided in The Yield Quest is for educational purposes only and does not constitute financial advice. DeFi investments carry inherent risks and can lead to capital loss. Readers should do their own research and assess their risk tolerance before implementing any strategy.